Additional Buyer’s Stamp Duty ABSD Singapore

What is ABSD?

ABSD is Additional Buyer’s Stamp Duty where the buyers are required to pay the stamp duty to Inland Revenue Authority of Singapore (IRAS) for the product.

What is the ABSD rate if Singapore Citizen buying first / second residential property?

Current ABSD rates for

- 1st property: NA

- 2nd property: 20%

- 3rd and next: 30%

What is the ABSD rate if Singapore Permanent Resident (SPR) buying first / second residential property?

Current ABSD rates for

- 1st property: 5%

- 2nd property: 30%

- 3rd and next: 35%

Download Additional Buyer’s Stamp Duty (ABSD) Declaration Form

Can a foreigner buy a residential property in Singapore and What is the ABSD Rate?

Yes foreigner can buy a property in Singapore. They need to pay 60 % ABSD rates.

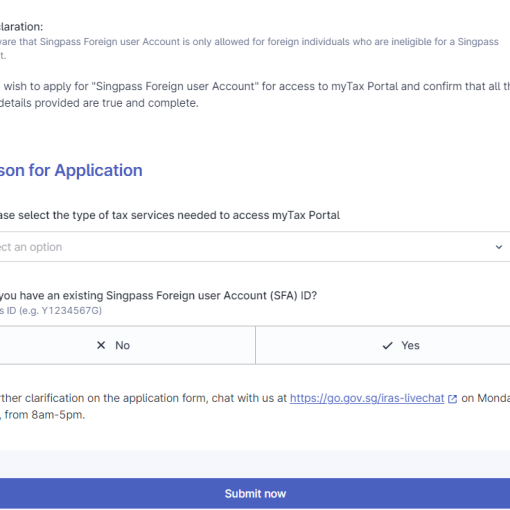

How to apply for ABSD refund?

- Visit https://mytax.iras.gov.sg/

- Login with your SingPass

- Select “Request” and Select “apply for assessment / appeal

- Under Assessment, select “Remission and Penalty”

For more details, visit here

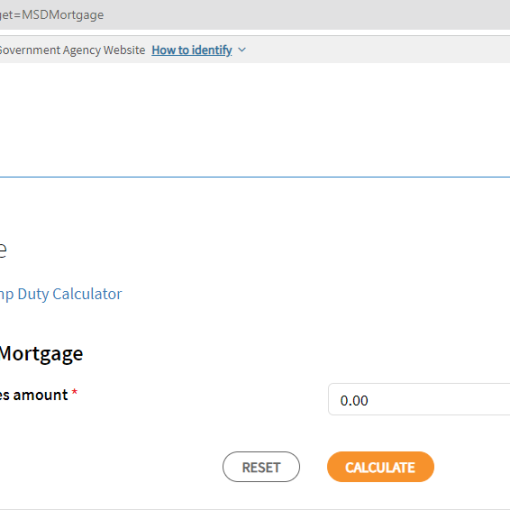

How to e-stamp online?

- Visit https://mytax.iras.gov.sg/estamping/

Services you can do through e-stamp?

- e-stamp the document

- Pay Additional Stamp duty

- Stamp certificate can be amended and retrieved

- Request refund

Location where can you can do e-stamp your documents in Singapore

| Branch | Address | Opening Hours |

|---|---|---|

| City Square Post Office | City Square 180 Kitchener Road #B2 – 33 Singapore 208539 |

Mon – Sat 10.00am – 7.00pm |

| Orchard Post Office | ION Orchard 2 Orchard Turn #B2-62 Singapore 238801 |

Mon – Sun 10.30am – 8.00pm

|

| Raffles Place Post Office | Ocean Financial Centre 10 Collyer Quay #B1-11 Singapore 049315 |

Mon – Fri 8.30am – 6.00pm

|

| Shenton Way Post Office | Downtown Gallery

6A Shenton Way #03-23 Singapore 068815 |

Mon – Fri 8.30am – 6.00pm

|

How to contact IRAS e-Stamp Singapore?

Email your queries at estamp@iras.gov.sg

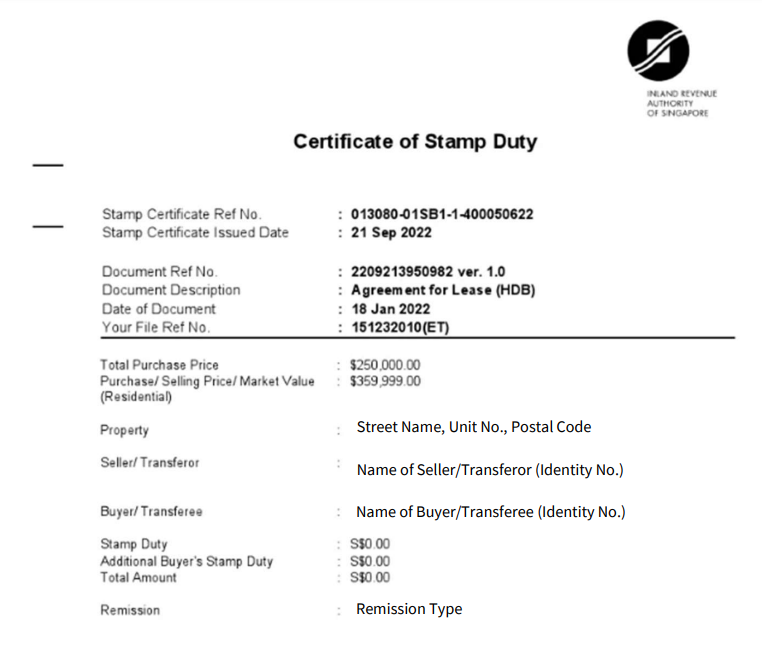

#2 Ways to Retrieve the Stamp Certificate in Singapore

- Visit the e-stamp portal website

- Login using your credentials

- Select Stamp duty under Inbox

- Now Search the stamp certificate using “Document reference number / IRAS case reference number”

- Download the certificate

(OR) Follow the othe rprocedure

Visit the e-stamp portal website

Login using your credentials

Select “Search records / cases under Records”

Search the stamp certificate using “Document reference number / IRAS case reference number / File reference number / Property address”

Download the e-stamp certificate