Contents

- 1 What is Stamp Duty Singapore? How to buy/sell a property? Calculate the stamp duty amount using calculator

- 2 Can Singapore PR / Foreigner buy a property in Singapore?

- 3 Stamp Duty Calculator

- 4 Seller Stamp Duty Singapore Rates in Singapore

- 5 e stamping iras Singapore

- 6 How can a foreigner in Singapore access the IRAS / e-Stamping portal?

- 7 Where to e-Stamp your document in Singapore Post Office?

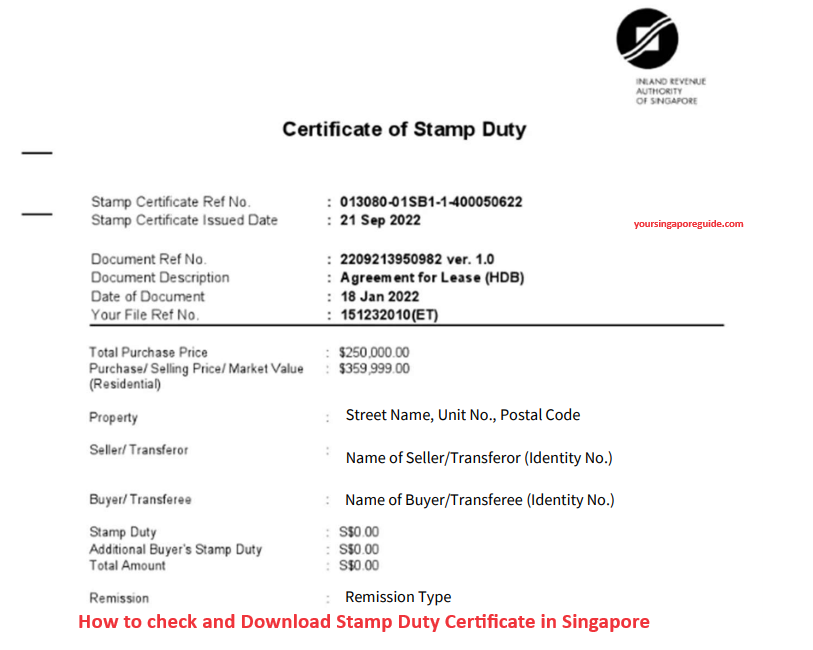

- 8 How to check and Download Stamp Certificate?

What is Stamp Duty Singapore? How to buy/sell a property? Calculate the stamp duty amount using calculator

Things you can do stamp duty for

- Lease/Tenancy

- Buy/Residential / non Residential property

- Ordinary shares transfer

- Sell Residential / Industrial Property

- Mortgage

Can Singapore PR / Foreigner buy a property in Singapore?

Yes, they can buy.

Buy Residential Property Calculator

- Visit https://mytax.iras.gov.sg/ESVWeb/default.aspx?target=MSDBuyResidentialProperty

- Select any one from Individual buyer / Couple / Company

- Enter the purchase details

- Select whether you are Singapore citizen / PR / Foreigner

- If you are not a citizen, please select the nationality

- Select the type of property

Stamp Duty Calculator

Example calculation using Stamp Duty Calculator for buying property for Singapore Citizen, PR, Foreigner

Individual buyer/Married Couple

Property value: SG$45,000/-

Value for 1 property

| Type | Stamp Duty Amount |

| Singapore Citizen | $450 |

| PR | $2700/- |

| Foreigner | $27450/- |

- For PR, you need to pay the stamp duty amount of $2700/-

- For Singapore Citizen, the value of $450 must be paid as a stamp duty amount

- Foreigner needs to pay $27,450/- as a stamp duty amount

Stamp Duty amount payable for Singapore Citizen

For Singapore PR

For Foreigner

Seller Stamp Duty Singapore Rates in Singapore

For up to 1 year, you need to pay 12 % and for above 1 to 2 years, the rate is 8%. Finally for 2 to 3 years the rate is 4% and no Seller stamp duty (SSD) rate for more than 3 years

e stamping iras Singapore

Login IRAS using SingPass for e stamping through https://mytax.iras.gov.sg/estamping/ to acquire the following services

- Your document can be e-stamped

- Pay ASD (additional stamp duty)

- Stamp certificate can be received

- Refund request can be done

- Get Adjudication / appeal

How can a foreigner in Singapore access the IRAS / e-Stamping portal?

Do you really need SingPass to access IRAS e-stamp website?

Those who are a foreigner who has not SingPass account, they should apply for Singpass Foreign User Account (SFA) and access the e stamp portal. Otherwise they can get the landlord/agent help on behalf of them.

Where to e-Stamp your document in Singapore Post Office?

Currently three post offices are doing e-stamp work. They are:

How to check and Download Stamp Certificate?

-

- Login IRAS

- Select Stamp Duty

- Under the menu “Records”, scroll and select “Search Records / Cases

- Enter the required details

- Now click Download to get the certificate